Coalition loyalty programs let customers earn and redeem points across multiple brands under one umbrella. You shop at different stores but collect rewards in a single account that works everywhere in the network.

These programs solve real pain points for customers and businesses. Customers hate juggling dozens of loyalty cards and apps. Businesses struggle to compete with retail giants who can afford massive standalone rewards programs.

This guide shows you exactly how coalition loyalty programs work, which platforms deliver the best results, and how to choose the right solution for your business. You’ll see real pricing data, feature comparisons, and customer reviews from actual users.

What Are Coalition Loyalty Programs and How Do They Work

A coalition loyalty program connects multiple non-competing businesses into one shared rewards network. Customers sign up once and earn points from every partner company in the system.

The member shops at Partner A and earns 100 points. They visit Partner B next week and earn 150 more points. Both transactions add to the same account balance. The customer redeems 200 points at Partner C for an exclusive discount.

All three businesses share the program infrastructure and split the costs. They pool customer data to understand shopping patterns better. Each partner pays based on how much their customers use the program.

You don’t need to build customer loyalty programs from scratch. The coalition operator manages the loyalty platform, customer service, and fraud monitoring. Your business plugs into an existing system with millions of active members already enrolled.

The Business Model Behind Coalition Loyalty Networks

Coalition programs make money by charging partners membership fees and transaction costs. The operator builds the technology platform once and licenses it to multiple businesses.

Partners pay a setup fee to join the network. They also pay per transaction whenever a customer earns or redeems points. Some coalitions charge monthly subscription fees based on transaction volume.

The operator pools marketing budgets from all partners. This creates a bigger promotional fund than any single business could afford alone. Members see more advertising and better rewards because costs get distributed.

Customer acquisition and retention becomes cheaper for everyone involved. New members who join through Partner A automatically become available to Partner B and Partner C. The network effect drives down marketing costs per customer.

Data sharing increases the lifetime value for all participants. Partners see purchase patterns across industries they couldn’t access alone. A coffee shop learns that their customers also shop at specific bookstores and movie theaters.

The coalition keeps a percentage of unredeemed points as revenue. Studies show 30 to 40 percent of loyalty points never get used. This breakage creates profit for the operating company.

Coalition vs Standalone Loyalty Programs: Key Differences

- Coalition loyalty programs let customers earn and redeem points across multiple brands under one umbrella.

- Standalone programs operate independently with complete control over every aspect. The choice between these models fundamentally shapes your loyalty strategy and costs.

| Feature | Coalition Loyalty Programs | Standalone Loyalty Programs |

| Time to Launch | 2 to 6 weeks | 6 to 18 months |

| Initial Member Base | Instant access to existing members (50,000 to 5 million+) | Start from zero members |

| Member Acquisition Cost | Near zero (shared network) | $25 to $150 per new member |

| Technology Ownership | Rented/licensed from operator | You own the platform |

| Platform Maintenance | Handled by coalition operator | You manage updates and fixes |

| Customer Data Ownership | Shared with coalition operator | 100% owned by you |

| Cross-Industry Insights | Yes (see patterns across partners) | No (only your business data) |

| Earning Rate Flexibility | Operator sets baseline rates | You control all earning rules |

| Redemption Options | Members redeem across all partners | Limited to your products/services |

| Member Communication | Compete with other partner messages | Exclusive access to your members |

| Program Customization | Limited to operator’s framework | Fully customizable to your needs |

| Fraud Prevention | Shared security infrastructure | You build your own systems |

| Analytics Capabilities | Standard reports across partners | Custom analytics you design |

| Member Engagement Rate | 15% to 35% (diluted across partners) | 40% to 60% (focused on your brand) |

| Best For | Small to mid-sized businesses, cost-sensitive companies, businesses wanting quick launch | Large enterprises, brands prioritizing control, companies with unique value propositions |

How Points Accumulation Works Across Partner Networks

Points accumulation follows rules set by the coalition loyalty management. Each partner assigns point values to dollar amounts or specific actions. The central system tracks everything in one member account.

The simplest model awards one point per dollar spent. You spend $50 at the grocery store and earn 50 points. Bonus multipliers encourage shopping at specific times.

Product-level earning lets partners reward specific purchases. The pharmacy gives triple points on vitamins. The restaurant offers five points per dollar on appetizers. These targeted incentives drive customers toward high-margin items.

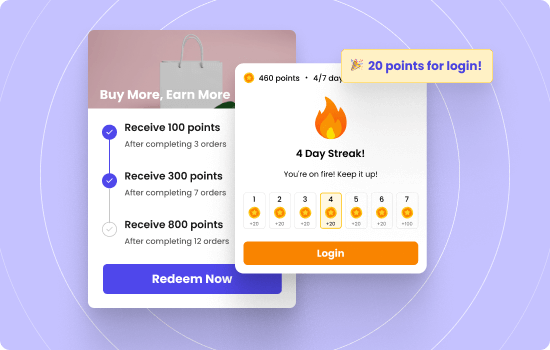

Non-purchase actions also generate points in modern coalitions. Writing a product review earns 25 points. Connecting your social media accounts adds 50 points. Referring a friend brings 100 points when they make their first purchase.

The coalition operator processes all transactions through a central ledger. Partner A sends transaction data to the hub. The system credits points to the member account instantly. Partner B sees the updated balance when the customer shops there next.

Point pooling creates value for members. Small purchases at many partners add up to meaningful rewards. You earn 10 points buying coffee, 20 points at the bookstore, and 30 points getting gas. Those 60 points combine for a discount at any partner.

Expiration policies vary by coalition. Some programs never expire points. Others set 12 to 24 month windows. The operator must balance member satisfaction against liability on their books.

Revenue Sharing Models in Coalition Programs

Revenue sharing determines how partners split the costs of running the coalition. The operator collects fees from all partners and distributes rewards to loyal customers. Several models exist with different advantages.

Transaction-Based Model:

Partners pay a fee each time a member earns or redeems points at their location. The gas station pays $0.50 when you earn 100 points. The hotel pays $2.00 when you redeem 500 points. This model aligns costs with actual usage.

Redemption costs more than issuance in most coalitions. The partner where points get redeemed bears the largest share. This encourages partners to promote earning over redemption. Customers who earn lots but redeem rarely generate the most profit.

Membership Fee Model:

Partners pay fixed monthly or annual fees based on their size. A small business might pay $500 monthly while a large chain pays $5,000. Transaction fees stay lower or disappear entirely. This model provides predictable costs.

The downside hits partners who drive less traffic. You pay the full membership fee even if your customers rarely use the program. High-volume partners get better value than low-volume ones.

Hybrid Model:

Most successful coalitions combine both approaches. Partners pay a base membership fee plus per-transaction costs. The membership fee covers platform access and customer service. Transaction fees fund the actual rewards.

This balances predictability with fairness. Partners know their minimum costs upfront. Additional fees scale with the value they receive from the program. The operator generates stable baseline revenue.

Point Purchase Model:

Some coalitions sell points to partners at wholesale rates. You buy 10,000 points for $800 upfront. You distribute those points to customers over time. This transfers liability from the operator to the partner.

Partners can negotiate volume discounts on point purchases. Buying 100,000 points might cost $7,000 instead of $8,000. You control your reward point system’s budget more precisely. The operator gets cash upfront instead of waiting for transactions.

Cross-subsidization helps smaller partners compete. Large partners with high transaction volumes subsidize the program for everyone. Small businesses access enterprise-grade loyalty technology at affordable rates. The network effect benefits all participants.

Regional Coalition Success Stories: Nectar, Payback, and Flybuys

Real-world coalitions demonstrate what works at a massive scale. Three programs dominate their respective markets with different approaches. You can learn from their successes and failures.

Nectar (United Kingdom)

Nectar launched in 2002 and grew to 19 million active members. The coalition includes Sainsbury’s grocery stores, eBay, Argos, and British Airways. Members collect points shopping for everyday needs then redeem for flights or merchandise.

The program issues over 500 million points daily. Sainsbury’s accounts for 60% of point issuance but only 40% of redemptions. Members earn at the grocery store and splurge on travel rewards. This cross-category behavior defines successful coalitions.

Nectar introduced digital-only membership in 2015. Physical cards disappeared and members used mobile apps exclusively. The transition took 18 months and reduced operating costs by 30%. Digital tracking provides richer data than card swipes.

Partner turnover challenged the coalition over time. Major partners like Homebase and BP exited the program. Nectar replaced them with online retailers and restaurant chains. Maintaining partner diversity requires constant recruitment.

Payback (Germany and Beyond)

Payback operates in seven countries with 31 million members in Germany alone. The coalition partners include DM drugstores, Rewe supermarkets, Aral gas stations, and Lufthansa airlines. Over 600 partner brands participate across Europe.

The program processes 1.5 billion transactions annually. Average member activity reaches 40 transactions per year. The high engagement comes from dense partner coverage. You find participating locations everywhere you shop.

Payback invested heavily in mobile technology early. Their app includes location-based offers that trigger when you approach a partner store. Push notifications boost redemption rates by 25%. Geo-targeting requires sophisticated infrastructure.

Multi-country operations created complexity. Each nation has different privacy laws and currency systems. Payback built modular systems that adapt to local regulations. The core platform stays consistent while regional variations handle compliance.

Flybuys (Australia)

Flybuys serves 8.5 million Australian households. Coles supermarkets anchor the coalition alongside Shell gas stations, Kmart, and Target. Members earn points on 50% of their weekly shopping.

The program pioneered family account linking. Multiple household members earn into one shared pool. Parents see what kids purchase without accessing payment details. Family accounts increase engagement by 35%.

Flybuys introduced instant redemption at checkout. You earn 100 points buying groceries then immediately use them for a discount. The instant gratification changes how members perceive value. Traditional programs require separate redemption visits.

Data analytics drive partner recruitment strategy. Flybuys identifies gaps in their partner network by analyzing member spending outside the coalition. They recruit partners in categories where members shop frequently. This data-driven approach maximizes relevance.

All three programs faced challenges with point liability. Billions of unredeemed points create accounting headaches. They combat this through expiration policies and redemption promotions. The balance between member satisfaction and financial health requires constant adjustment.

Marketing Automation Features Across Coalition Platforms

Modern coalition platforms include sophisticated marketing automation. You create targeted campaigns that reach relevant members automatically. The system tracks performance and optimizes future promotions.

Segmentation Tools:

You build customer segments based on dozens of attributes. Purchase frequency, average transaction size, preferred categories, and geographic location all work as filters. The pharmacy targets members who bought vitamins in the last 30 days. The restaurant reaches people who haven’t visited in 60 days.

Predictive segments use machine learning to identify future behaviors.The system identifies members with high churn rates predicted over the next three months.. You send retention offers before they leave. Lookalike modeling finds members similar to your best customers.

Triggered Campaigns:

Automated messages sent when members take specific actions. Automated birthday rewards send bonus points during their special month.Welcome series educate new members about earning opportunities. Cart abandonment messages remind customers to complete online purchases.

Location triggers activate when members enter partner stores. The coffee shop sends a promotion as you walk past. Beacon technology or GPS enables these geo-targeted offers. Open rates for location-based messages exceed 40%.

A/B Testing Framework:

You test different subject lines, offers, and creative elements. Half your segment receives Offer A while the other half gets Offer B. The platform tracks which version drives more redemptions. Winning variants become the new standard.

Multivariate testing handles complex scenarios with multiple variables. You test subject line, image, and call-to-action combinations simultaneously. The system identifies the optimal combination faster than sequential tests.

Cross-Partner Promotions:

Coalition platforms enable joint promotions between partners. The grocery store offers bonus points when you also shop at the pharmacy. Two partners share the cost while both benefit from increased traffic. The system tracks multi-partner behavior automatically.

Partner recommendation engines suggest where members should shop next. You bought running shoes so the app recommends sports nutrition at the pharmacy. These recommendations increase cross-shopping by 20%.

Content Personalization:

Customized email and app content adapt to individual preferences. Members who redeem for travel see airline partner offers first. Families with children see toy store promotions. The platform assembles personalized rewards and experiences from modular content blocks.

Send time optimization determines when each member receives messages. Machine learning finds the hour when each person most likely opens emails. Some members respond best at 7am while others prefer 8pm. Personalized timing improves engagement by 15%.

Performance Dashboards:

You track campaign metrics in real-time. Open rates, click-through rates, and conversion rates update continuously. The dashboard shows ROI for each promotion. You identify which offers drive profitable behavior.

Attribution modeling shows how marketing touchpoints work together. A member sees an email, clicks a push notification, then redeems in-store. The system credits all three touchpoints appropriately. This prevents over-investing in last-click channels.

Customer Acquisition Costs in Coalition vs Standalone Models

Customer acquisition costs differ dramatically between coalition and standalone programs. The math determines which model makes financial sense for your business. Real numbers from actual programs illustrate the differences.

Standalone Program Acquisition:

You must acquire customers yourself through advertising and promotions. Typical costs range from $25 to $150 per new member. Retail businesses skew toward the lower end while credit cards and travel programs exceed $100 per member.

Marketing channels include email campaigns, social media ads, in-store signage, and direct mail. You need multiple touchpoints before customers enroll. The signup process must be simple or potential members abandon it.

Promotional incentives like signup bonuses increase enrollment but raise costs. Offering 500 points for joining costs you $5 to $15 depending on point value. These points might get redeemed immediately without driving future purchases.

Coalition Program Acquisition:

You gain immediate access to existing members when you join. A mature coalition might have 5 million active members already enrolled. Your customer acquisition cost for these members approaches zero.

New members who join through any partner become available to all partners. The grocery store recruits someone who becomes your customer too. Shared customer acquisition spreads costs across the entire network.

The coalition operator handles most member communication and support. You avoid staffing a loyalty help desk. The operator’s economy of scale reduces per-member costs for everyone.

Financial Modeling Example:

Consider a regional coffee chain with 20 locations. Building a standalone program requires these investments:

Technology platform development costs $50,000. Marketing to acquire 10,000 members costs $350,000 at $35 per member. First year operating costs including staff and support total $150,000. Total first year cost reaches $550,000.

The coalition alternative looks very different. Join an existing network with 2 million members. Setup fee costs $5,000. Monthly fees of $499 plus transaction fees around $18,000 annually. First year cost totals $29,000.

You sacrifice some control in exchange for 98% cost reduction. The 2 million existing members represent potential customers you couldn’t afford to acquire alone. Even capturing 1% of them exceeds what you’d enroll in a standalone program.

Break-Even Analysis:

Standalone programs require years to recover acquisition costs. You need each member to generate $55 in incremental profit if acquisition costs $55. Average members take 18 to 36 months to break even.

Coalition programs reach profitability faster. Lower acquisition costs mean members become profitable within 6 to 12 months. The faster payback reduces financial risk.

How Small Businesses Benefit From Coalition Networks

Small businesses face unique challenges competing against large chains. Coalition loyalty programs level the playing field in several ways. You gain capabilities that would otherwise remain out of reach.

Technology Access:

Enterprise-grade loyalty platforms cost hundreds of thousands to build. Coalitions provide the same technology for monthly fees under $500. You get mobile apps, analytics dashboards, and fraud protection without massive investment.

The technology automatically updates with new features. The coalition operator handles software maintenance and security patches. You focus on your business instead of managing technology infrastructure.

Network Effects:

Joining a coalition with hundreds of partners instantly makes your loyalty program more valuable. Members earn points across many businesses and redeem them at yours. This flexibility attracts customers who ignore single-brand programs.

Your small business appears alongside major brands in the member app. This association increases perceived legitimacy. Customers trust the coalition’s established reputation.

Marketing Reach:

The coalition operator sends promotional communications on your behalf. Your offers reach millions of members you couldn’t contact independently. Even 0.1% response from 2 million members generates 2,000 new customers.

You participate in coalition-wide campaigns during holidays and special events. The grocery store’s back-to-school promotion might mention your sporting goods store. Cross-promotions expand your audience without additional marketing spend.

Data Insights:

Access to aggregated shopping data reveals customer patterns you couldn’t see alone. You learn what else your customers buy and where they shop. The bookstore discovers their customers also frequent coffee shops and cinemas.

This intelligence guides business decisions beyond loyalty. You might adjust store hours, change product mix, or select better locations. The data becomes a competitive advantage separate from the rewards program.

Cash Flow Benefits:

Standalone programs require funding point liability upfront. You set aside money for rewards members will eventually claim. This locks up working capital you might need elsewhere.

Coalition programs often handle point liability. The operator manages the financial reserves required. Your costs align with actual transactions rather than future obligations. This improves cash flow predictability.

Professional Support:

Coalition operators employ loyalty experts who help optimize your participation. You get advice on earning rates, promotional strategy, and member engagement. This expertise would cost $100,000+ annually to hire internally.

Customer service teams handle member inquiries about the program. You avoid training staff on loyalty system details. Members contact the coalition operator directly with technical questions.

Risk Reduction:

Testing loyalty concepts in a coalition costs less than building standalone programs. You learn what works before making bigger investments. Exit costs remain low if the program doesn’t deliver results.

The established coalition has proven member engagement. You avoid the risk that nobody joins your standalone program. The member base exists before you invest a dollar.

Small restaurant chains, independent retailers, service businesses, and local franchises gain the most. You compete on loyalty without matching the budgets of national chains. The coalition democratizes access to sophisticated customer retention tools.

Your business still needs to deliver quality products and service. The loyalty program amplifies your existing strengths but cannot compensate for fundamental problems. Use the coalition to reward customers who already like your business.

Conclusion

Coalition loyalty programs give you access to shared infrastructure and established member networks. You plug into existing systems instead of building from scratch. The cost savings and instant scale make coalitions attractive for most businesses.

Success requires active participation beyond just joining. You must promote the program to customers and create compelling offers. The coalition provides tools but you drive member engagement at your locations.

Customer data sharing raises privacy concerns that programs must address transparently. Members need clear control over their information. Coalitions that prioritize data protection build stronger member trust and retention.

The technology infrastructure supporting coalitions must handle millions of transactions reliably. Real-time processing, fraud prevention, and mobile apps form the foundation. Choose platforms with proven scalability and security.

Also read:

- 50 Best Referral Program Examples That Actually Work

- 5 Best WooCommerce Referral Plugins (2025)

- Tiered Loyalty Programs: How to Set Up+ Examples

- 6 Types of Loyalty Programs & Pick the Best for Your Brand

- B2B Loyalty Programs: Complete Guide With Types, Examples & How-tos

- 8 Best Customer Strategy Examples That Work