Customer Lifetime Value (CLV) is one of the most powerful metrics for understanding long-term profitability.

In fact, a 5% increase in customer retention can boost profits by 25% to 95%, according to research by Bain & Company.

CLV goes beyond individual sales and reveals the total value a customer brings over their entire relationship with your business.

In this blog, we’ll explore,

- What is Customer Lifetime Value (CLV)

- Types of CLV Models

- How to Calculate CLV: Formulas and Examples

- Strategies to Increase CLV

- Real-Life Examples and Case Studies

- Common Mistakes and Myths about CLV

- CLV Benchmarks by Industry and Segment

Increase your ROI upto 20X with WPLoyalty’s customizable loyalty campaigns and reward your loyal customer easily.

What is Customer Lifetime Value (CLV)?

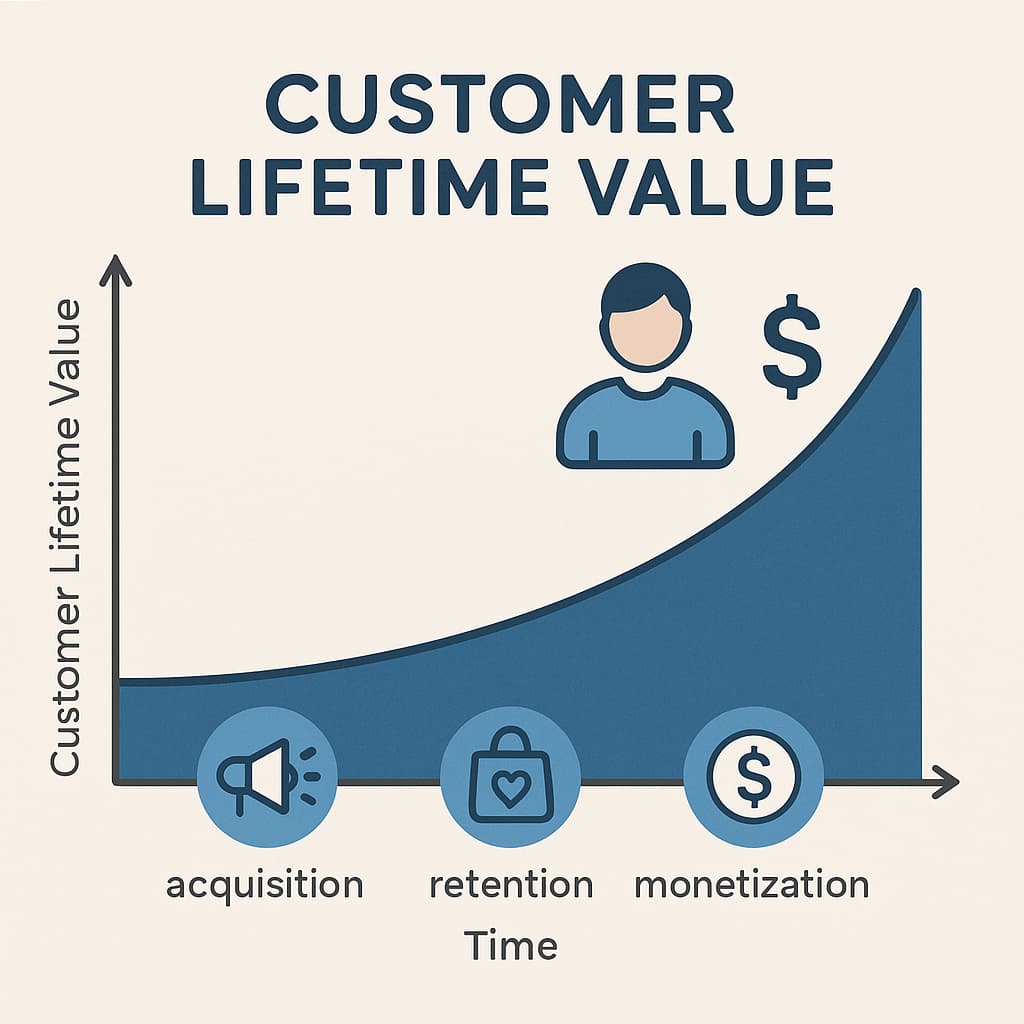

Customer Lifetime Value (CLV) also called Lifetime Value (LTV) is a metric that estimates the total revenue a business can expect from a single customer account over the entire duration of the journey.

Rather than looking at a customer’s single purchase, CLV accounts for repeat purchases, subscription renewals, upgrades, and any ongoing revenue streams attributable to that customer.

For example, if a typical customer in an online store spends $50 per order, orders 3 times a year, and stays active for 2 years, their CLV would be $50 × 3 × 2 = $300.

To calculate Customer Lifetime Value (CLV), you can use the formula:

CLV = ARPU × Gross Margin % × Average Customer Lifespan

where ARPU is average revenue per user and average lifespan is how long they remain a customer.

Why is CLV Important for SaaS and eCommerce?

Here are several reasons why CLV is a critical metric:

- Long-Term Profitability: A high CLV indicates that customers keep coming back and spending, which usually translates to greater profit over time.

- Informs Marketing & Sales Spend: CLV provides a guideline for how much you can spend to acquire a customer (CAC) and still remain profitable. A common rule of thumb is to maintain LTV to CAC around 3:1, meaning the lifetime value is about three times the cost of acquiring that customer.

- Customer-Centric Strategy: CLV forces you to think beyond initial transactions and focus on customer relationships. CLV helps identify your most loyal, high-value customers who make repeat purchases.

- Retention vs. Acquisition Balance: It’s widely cited that acquiring a new customer can cost 5 – 7× more than retaining an existing one. By focusing on CLV, businesses naturally invest in keeping customers happy – by providing better support, managing loyalty programs, and continuously improving products.

- Forecasting and Business Health: CLV is a forward-looking indicator of your business’s health. Tracking CLV over time can reveal if your customer quality or loyalty is improving or declining.

Types of CLV Models: Historic vs. Predictive

There are two broad approaches to modeling Customer Lifetime Value:

1. Historic (Backward-Looking) CLV

This method calculates CLV based on past or current data – essentially, what the customer has spent so far. It’s a snapshot of value up to the present.

For example, taking a customer’s total payments to date as their historic CLV.

A more typical approach is to use average revenue per user (ARPU) over a period and extrapolate it.

One formula for historical CLV is:

Historical CLV = (Total revenue from customer ÷ Number of months as a customer) × 12

Another technique is using cohort analysis – looking at customers who joined in the same time period and averaging their revenues over time.

Historical CLV is relatively straightforward but does not account for what the customer might do in the future.

2. Predictive (Forward-Looking) CLV:

Predictive CLV attempts to forecast the total value of a customer by projecting future behavior, not just looking at the past.

This model uses historical data plus predictive analytics or assumptions about customer retention rates, purchase frequency changes, and monetary value to estimate what a customer will be worth over their remaining lifetime.

CLV is more complex and requires more data (and care with assumptions), but it’s extremely useful for decision-making because it identifies high-value customers early and helps guide marketing investments.

Which to use?

Historic CLV is mainly informative – it’s easy to calculate and can reveal patterns among past customer segments, but it’s less actionable for future strategy.

Predictive CLV, while harder to compute, is more actionable. It allows you to target customers who are predicted to be high-value (even if they haven’t spent much yet) and proactively intervene with those at risk of low lifetime value.

Most modern CLV analysis in SaaS and sophisticated eCommerce trend uses predictive models.

How to Calculate CLV: Formulas and Examples

Calculating Customer Lifetime Value involves a few pieces of data. At its simplest, CLV is the product of three components:

- Average value per purchase (or per billing period),

- Frequency of purchases (or transactions) within a time frame,

- Average customer lifespan (in that same time unit or number of periods).

Multiplying these together yields an average lifetime value. Let’s break down the calculation for different business models:

1. CLV Formula for E-Commerce (Transactional Model)

For retail or eCommerce businesses, customers make discrete purchases (not a continuous subscription). The classic formula is:

CLV = (Average Purchase Value) × (Purchase Frequency) × (Average Customer Lifespan)

Average Purchase Value (APV) – Also known as Average Order Value (AOV). This is how much, on average, a customer spends per order.

Formula: AOV = Total Revenue / Total Number of Orders

For example, if your online store made $100,000 from 2,000 orders last year, your AOV = $50.

Purchase Frequency (F) – How often the average customer makes a purchase in a given period (usually per year).

Formula: Purchase Frequency = Total Number of Orders / Total Number of Unique Customers.

If those 2,000 orders came from 500 customers in a year, then on average each customer made 4 orders/year.

Average Customer Lifespan (L) – How long a customer remains active before becoming dormant or churning. This can be measured in years (or months).

For example, if on average customers tend to purchase over a span of 2 years before fading away, then lifespan = 2 years.

Putting it together: Suppose Average Purchase Value = $50, Purchase Frequency = 4 per year, and Average Lifespan = 2 years.

Then CLV = $50 × 4 × 2 = $400. This means the average customer brings in $400 of revenue over their lifetime with the business. If profit margin is, say, 30%, then the profit CLV would be $400 × 0.30 = $120 in profit.

Strategies to Increase CLV (Product, Marketing, Retention, Upselling)

Increasing Customer Lifetime Value boils down to doing one (or all) of the following: getting customers to stay longer, buy more, and/or buy more often, all while keeping them satisfied so they don’t churn.

Below are several proven strategies to boost CLV:

- Improve Onboarding and Early Experiences: First impressions count. Ensure the first purchase experience (from website UX to delivery) is excellent – a happy first-time buyer is much more likely to become a repeat buyer.

- Enhance Customer Support and Success: Keeping customers happy is fundamental to extending their lifetime. Invest in responsive, helpful customer support across channels (email, chat, phone, social).

- Personalization and Segmented Marketing: Use data to tailor recommendations, offers, and content to each customer’s interests and past behavior. Implement personalized product recommendations (e.g., “You might also like…” or tailored email offers).

- Upselling and Cross-selling: One of the fastest ways to boost CLV is to increase the average revenue per customer through upsells (upgrade to higher-priced plans or add-ons) and cross-sells (related or complementary products).

- Introduce Loyalty Programs: A loyalty or rewards program can dramatically increase purchase frequency and retention in eCommerce. By rewarding customers with points and discounts you give them an incentive to choose your brand for repeat purchases.

- Optimize Pricing and Offer Value: Pricing strategy can impact CLV. Analyze if your pricing model encourages longer relationships. Bundling products or creating subscription plans for consumable goods can also raise CLV.

- Retention Marketing & Win-Back Campaigns: Proactively engage customers to keep them coming back. Use customized email newsletters, SMS updates, or push notifications to stay on customers’ radar.

- Community and Referral Programs: While referrals bring new customers (affecting acquisition more than an individual’s CLV), a referral program can increase the loyalty of the existing customer who refers.

Every strategy above aims at either getting customers to spend more or stay longer (or both).

Related reading: Discover the best referral plugins for WooCommerce to help you choose the right one for your business.

Create a customizable point-based loyalty programs with WPLoyalty’s pre-built loyalty campaigns and reward your loyal customer easily.

Real-Life Examples and Case Studies

Seeing how real companies leverage CLV can be inspiring. Here are a few examples across SaaS and eCommerce that illustrate the impact of focusing on customer lifetime value:

1. 123BabyBox (Subscription E-Commerce)

This children’s subscription box service noticed via CLV analysis that many subscribers were cancelling after three months, creating a drop-off in lifetime value.

To combat this, the company restructured its pricing and subscription tiers: a monthly plan costs $59.99, but longer subscriptions get progressively cheaper per box (down to $39.99 per box for an annual plan).

They also added perks for long-term subscribers (like early access to products) as an incentive to stick around.

The result was a 40% increase in CLV within a year – the average subscription length grew from 5 to 8 months, adding about $150 in additional revenue per customer.

Churn dropped by 18%, and referrals increased as customers felt part of something special. This example shows how adjusting your offering based on CLV data (identifying when and why customers lapse) can directly boost lifetime value.

2. Amazon Prime (E-Commerce Loyalty)

Amazon is often cited for its focus on lifetime value. Prime membership is a case in point – Prime members tend to spend far more than non-Prime customers on Amazon.

In fact, one study found Prime customers spend about $1,340 per year vs. $600 per year for non-Prime shoppers.

By investing in the Prime program (free shipping, exclusive deals, content like Prime Video), Amazon increases purchase frequency and retention dramatically.

The estimated lifetime value of a Prime member was calculated at around $2,283 (using a 10% discount rate for future cash flows), compared to about $916 for a non-Prime customer.

Amazon is willing to spend on front-end benefits (even taking losses on shipping or discounts) because they know the long-term value of a loyal Prime customer more than makes up for it.

This exemplifies a CLV mindset: sacrificing short-term margins for long-term loyalty and revenue.

3. Starbucks (Loyalty and App)

Starbucks isn’t a SaaS or pure eCom business, but it’s a famous example of leveraging loyalty for CLV. They calculated the average lifetime value of a customer to be roughly $14,099.

This huge number comes from frequent purchases (daily coffees) compounded over years.

Starbucks introduced one of the first reward mobile apps, which gamified purchases (stars, free drinks) and made it super convenient to pay and order.

This loyalty program increased visit frequency and kept customers from drifting to competitors, directly impacting CLV.

So, Starbucks’ case underlines how investing in customer experience and rewards pays back in high CLV; their customers become very sticky, often staying with the brand for decades.

Related reading: Know the 10 best ways to reward your loyal customers and keep them engaged for long-term success.

4. Dropbox (SaaS Freemium Upsell)

Dropbox grew rapidly by using a freemium model and incentivizing referrals. Many users started free, but Dropbox offered extra space for referring friends.

This strategy not only acquired new users cheaply but also moved many free users to a usage level where upgrading to paid plans became attractive. Over time, a significant chunk of free users converted to paid.

By upselling to higher storage tiers and later offering business plans, Dropbox significantly increased the CLV of its user base.

A user who might have been worth $0 (free) became, say, a paying customer for 3 years at $100/year = $300 LTV. Multiply that by millions of users and it’s huge.

The takeaway: creative growth strategies that focus on lifetime relationship (even starting free) can yield high long-term value.

Each of these examples highlights a different lever of CLV. The common thread is customer-centric strategy – by delivering consistent value to the customer, the customer delivers value back to the company over a longer lifetime.

Common Mistakes and Myths about CLV

While CLV is a powerful metric, businesses can trip up in its calculation or interpretation. Beware of these common mistakes and myths surrounding Customer Lifetime Value:

- Mistake: Using revenue instead of profit in CLV calculations. One frequent pitfall is calculating CLV solely on revenue and ignoring the costs associated with serving the customer. This can overstate CLV significantly.

Always consider using contribution margin (revenue minus variable costs) for a more meaningful CLV. - Mistake: Not Accounting for the Time Value of Money. This is more of an advanced financial concern, but if your CLV model extends many years out, failing to discount future cash flows can mislead your decisions.

Incorporating even a modest discount rate in your CLV formula can provide a more realistic number, especially for investors evaluating your business. - Myth: “CLV is a precise, static number”. In reality, CLV is an estimate based on assumptions about customer behavior.

- Myth: “All High CLV Customers Are Good – Focus Only on Them”. Yes, high CLV customers are your bread and butter, but ignoring lower CLV segments entirely can be a mistake.

- Myth: “CLV is only a marketing metric”. Actually, CLV should be a company-wide metric. It’s relevant not just for marketing, but also for product (are we delivering value over time?), customer service (how are we keeping people), and finance (projecting revenue).

Avoiding these pitfalls will ensure that your CLV computations and strategies based on them are grounded in reality and lead to smart decision-making.

CLV Benchmarks by Industry and Segment

Customer Lifetime Value can vary drastically between industries and even within industries by customer segment. It’s useful to know some benchmarks or typical ranges to contextualize your own CLV:

1. SaaS (B2B Software)

SaaS companies often have high CLVs, especially in B2B where contract values are large. It’s not uncommon for SaaS CLV to be in the five or six figures.

For example, one analysis noted an average annual value of a SaaS customer around $55,000 – over multiple years that easily exceeds $100,000+ CLV.

Benchmark: Many SaaS aim for a 3+ year lifespan and a CLV that’s 3-5× their annual contract value. Also, the LTV:CAC ratio is a benchmark of efficiency: 3:1 is good, 5:1 might mean under-spending on growth, and 1:1 or 1:2 is a red flag.

2. E-Commerce (Retail)

In consumer retail, individual CLV is typically much lower than B2B, but you have more customers. CLV varies by product:

- High frequency / Consumables: Sectors like beauty, grocery, pet supplies often see repeat purchases. For example, beauty e-commerce stores average around $188 CLV per customer.

- Low frequency / Big-ticket: Sectors like furniture or luxury goods might have high AOV but low frequency, so CLV might not be much higher than the first purchase unless there’s a cross-sell.

- Fashion/Apparel: Often in the middle – moderate AOV, and if the brand has good retention, a customer might buy seasonally.

- Electronics: If you sell, say, phones or gadgets, CLV could be one big purchase plus maybe accessories or an upgrade later. This is why Apple, for example, introduced services and accessories to increase the lifetime value.

- Benchmark: A study by RJMetrics (now Magento Analytics) found that the top 1% of customers in e-commerce are worth up to 18x more than the average customer for some retailers. It’s very segmented. So an “average CLV” might hide that your best customers are worth hundreds or thousands more than your median.

3. Telecom / Subscription Services

Industries like cable, mobile carriers, gyms, etc., often calculate CLV. For example, a $100/month cable customer over 4 years is ~$4,800 CLV.

Telecom often has CLVs in the few thousands range because people might stay for several years.

4. By Customer Segment (within an industry)

It’s useful to consider that within any business, different segments have different CLVs:

- In SaaS: Small business vs Enterprise – Enterprise might have 10x the CLV of small, due to higher fees and longer retention.

- In E-commerce: New Customers vs Repeat Customers – Often, if you can get a customer to make 3 purchases, their likelihood of making 10 increases a lot. So a segment of customers who made it to 3 purchases might have a CLV multiple times that of the overall average.

- Geography: sometimes customers in one region have higher CLV if competition is lower or loyalty is higher.

- Acquisition source: e.g., organic search customers might have a different CLV than those from coupon sites.

Lastly, consider Customer acquisition cost in benchmarking too. Some industries have low CLV but also low CAC (e.g., mobile apps), while others have high CLV and high CAC (enterprise software). The goal is not to maximize CLV at all costs but to have a healthy ratio and growth.

Conclusion

Customer lifetime value is a foundational concept for any eCommerce business looking to grow sustainably.

In practice, start by computing your current CLV (even a rough estimate). Then ask: what’s the biggest leverage point to raise this? Is it reducing churn by 1%? Increasing average order value by $5? Acquiring more customers like our best ones?

Set strategies in motion for those levers and measure again. Over time, you’ll build a strong CLV engine – a business that efficiently turns new customers into long-term, loyal, high-value patrons.

Also read:

- Customer Pain Points: From Problems to Solutions

- B2B Loyalty Programs: Complete Guide

- How to Set Up a Woocommerce Referral Program?

- How To Create A WordPress Referral Program?

- 5 Best WordPress Loyalty Plugins 2025

Frequently Asked Questions

Calculate customer LTV by multiplying average purchase value by purchase frequency, then multiplying by average customer lifespan. The formula is: LTV = (Average Purchase Value × Purchase Frequency) × Average Customer Lifespan. Some models include profit margins in calculations.

The 80/20 rule (Pareto Principle) in CLV suggests that roughly 80% of your revenue comes from 20% of your customers. These high-value customers have significantly higher CLV and should be the focus of retention efforts and personalized marketing strategies.

A good CLV varies by industry, but it should be at least 3-5 times your customer acquisition cost (CAC). Subscription businesses typically aim for higher ratios. The key is comparing your CLV to industry benchmarks and ensuring it exceeds acquisition costs.

LTV (Lifetime Value) and CLTV (Customer Lifetime Value) are essentially the same metric. Both measure the total revenue expected from a customer throughout their relationship with your business.